Is LottoGo Legit?

Have you come across ads for LottoGo and wondered whether it’s a legitimate business or a scam? Here’s what it does and how it works. Is LottoGo Legit? LottoGo appears to be a legitimate company, and I couldn’t find any…

Have you come across ads for LottoGo and wondered whether it’s a legitimate business or a scam? Here’s what it does and how it works. Is LottoGo Legit? LottoGo appears to be a legitimate company, and I couldn’t find any…

Thinking about signing up for Cointree?. Sign up using this CoinTree promo code and you’ll get a bonus $10 in your account. Here is how it work: Cointree Promo Code Here is how to get a bonus $50 in your…

Cashrewards was an Australian cashback website that closed relatively suddenly in 2025. Here is what we know. How Cashrewards Worked Cashrewards paid its members to shop online and, in some cases, in-store. The website earned money through affiliate commissions when…

Thinking about signing up to CoinSpot in 2026? Before you do, make sure you use this Coinspot Referral Code: HWHPXV. You’ll get a bonus $10 worth of Bitcoin when you sign up and make your first deposit thanks to CoinSpot’s refer…

Beem It is an Australian digital wallet that is mainly used to transfer money between friends and family. But have you ever wondered how Beem makes money? How Does Beem It Make Money Beem doesn’t charge any fees to transfer…

Just like everything else in Australia, the cost of cleaning supplies has also gone up. When you add up the costs of dishwashing tablets, sprays, laundry detergents and other cleaners you might find yourself paying more than $3 per day!…

With rising costs and an underperforming stock market, 2023 hasn’t been the best year for our finances. Now it’s more important than ever to have multiple streams of income. These are the best ways to make money online in Australia…

I’ve been a subscriber to Amazon Prime in Australia for the last 2 years. But is it actually worth getting Amazon Prime. And do the benefits outweigh the costs. Read on to discover my full review of Prime: Is It…

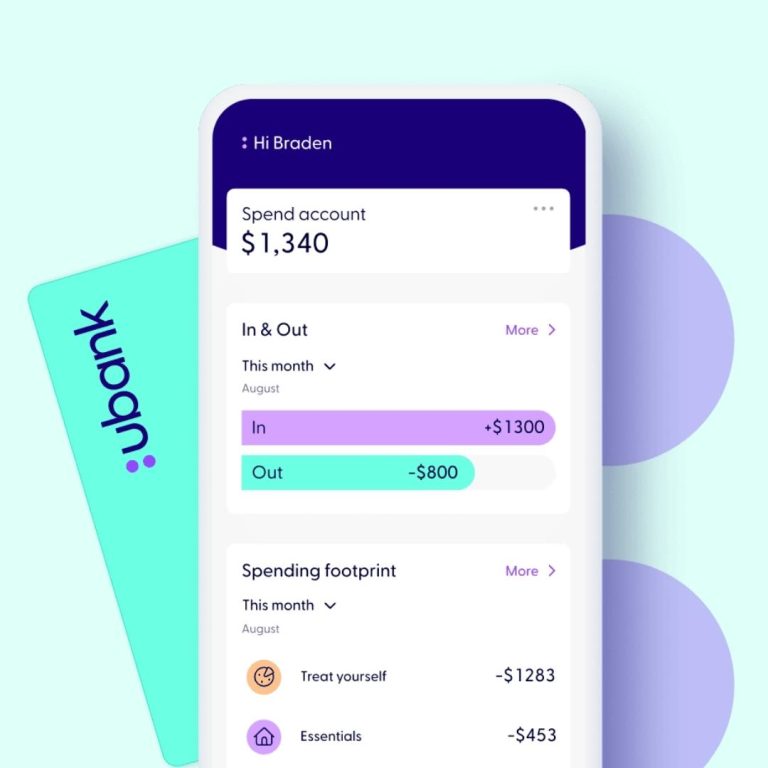

UBank is an Australian neo bank. When you sign up using a ubank referral code, you’ll get a bonus $20 completely free! Here is how to take advantage of this offer from UBank. ubank Referral Code Here is how to…

Here are 5 unique ways to save money on your travel bookings. Most people don’t take advantage of these simple and easy tactics that can reduce your travel costs by up to 20%. Earn Cashback on Your Bookings Using a…